Employer Resources

The Truth About 401(k)s

If you're a small business owner and you've considered offering a 401(k), this guide is for you.

While 401(k) plans can be a valuable part of retirement for many employees, they are far from perfect, and they require substantial employer resources to administer and maintain.

In this guide, we'll look at the challenges and advantages involved for employers and employees, as well as what the data show in terms of how effective they are at building retirement savings for the typical American worker. We'll attempt to answer the question, "For a small business, are they really worth it, in the end?"

What is the investment from the employer to set up a 401(k)?

A major and often overlooked investor in any traditional retirement plan is you, the employer.

Drawbacks for employers include significant time and cost (including fees), compliance with ERISA, SECURE, and non-discrimination, testing, reporting to government agencies (including forms 5500 and 1099-R), disclosing plan information to participants (SPDs, SMMs, IBSs, and SARs) and various other responsibilities involving in administering and maintaining employee plans. It's no wonder two-thirds of small business don't offer retirement plans.

So what will you (and your employees) get from all this time and cost...

How much should I expect my employees save if I open a 401(k)?

The short answer is, about $25,000-$50,000 per employee.

While half of all U.S. workers don't have access to savings plans (including two-thirds of those who work at small businesses), half do. So how did the employees who have had access to retirement plans end up?

According to the U.S. Census Bureau, of those who do have access to a 401(k), 403(b), 503(b), or Thrift Savings Plan, the median value of their savings is $30,000. After taxes, that number falls to $24,000.

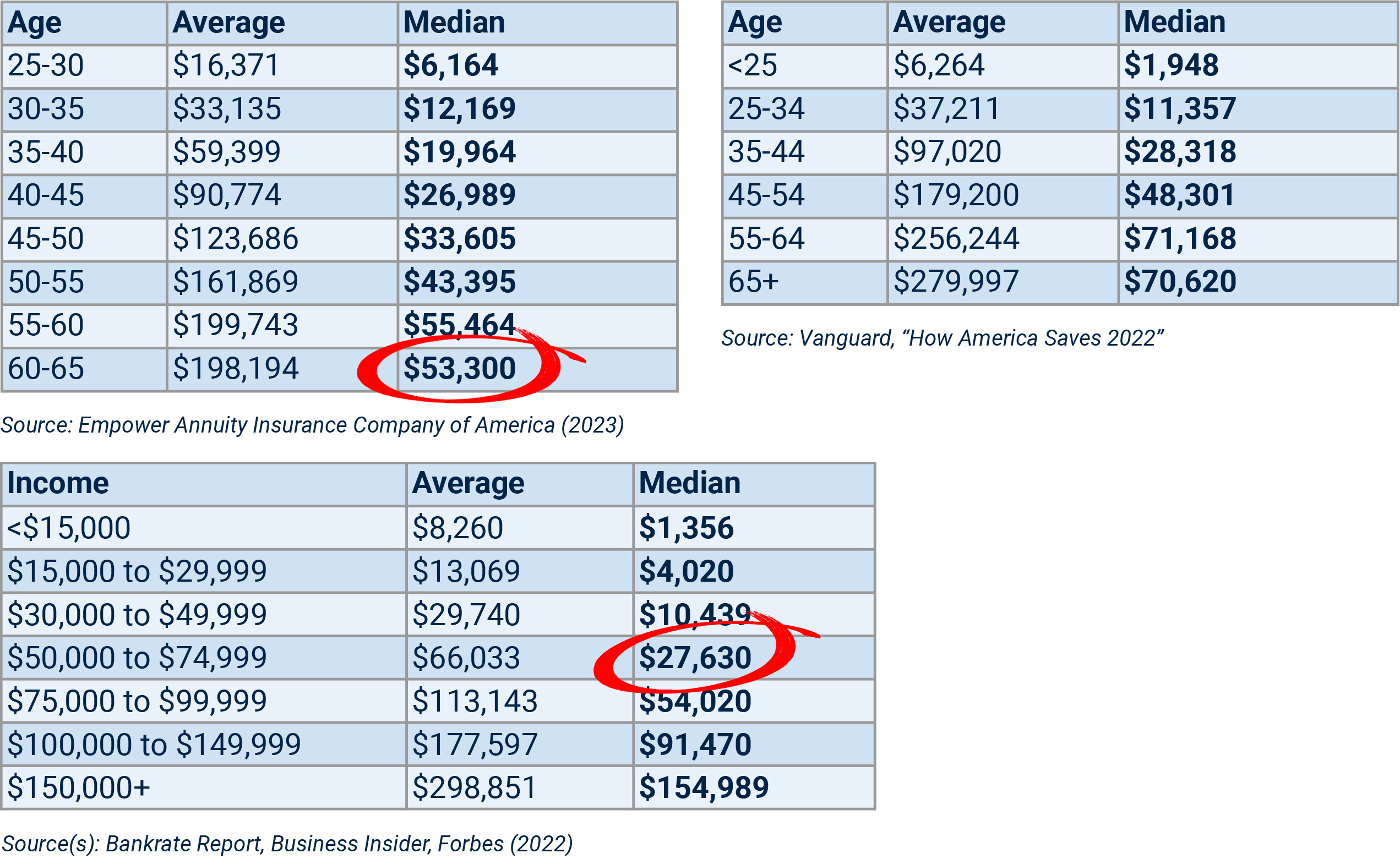

The charts below show the values saved by Americans in their 401(k) plans (sources here, here, and here). Data varies due to drops in balances from 2022 to 2023 (employees save less during hardships), but these sources should give us some insight.

Keep in mind that the averages are very heavily skewed toward the top 1% of earners, and that a much more meaningful number to look at is the median.

Typical 401(k) Balances by Age and Income

What we're left with is that the typical 401(k) retirement savings balance of an employee earning anywhere from $30,000 to $75,000 per year is somewhere between $10,000 and $55,000 (on the high end). After taxes, that number will fall to a range of $8,000-$44,000.

That's not a very big number.

Why are savings so small when 72% of employees say they "expect employers to offer" a retirement plan?

Most workers want to save for retirement, but can't afford to.

According to the U.S. Department of Justice, the median income for an employee in Texas is $49,996. Average household expenses come in at around the same number. Couples fare just slightly better at $65,708. But the fact is, after housing, auto loans, health insurance, utilities, and food and gas, there's little left over to save or invest.

An employee making $50,000 per year and contributing the national average for lower incomes (3-5%) will be contributing $1,500 per year. Even if we assume no market risk and 7% average annual growth, 401(k)s get hit by substantial fees (1% or more for smaller group plans), inflation (3%), taxes (20%), and an early withdrawal penalty (10%) if funds are taken out before the age of 59.5.

The ugly truth is that when it comes time to retire, employees will be doing well just to maintain the spending power of their total investment (typically adding up to just one year of income), especially if they are forced to withdraw those savings early, which happens 50% of the time, or if they take a new job. Shockingly, more than 80% of employees who withdraw their 401(k) while switching jobs drain their account completely, meaning they actually took a loss on their retirement plan after taxes and penalties!

I thought a 401(k) or 403(b) plan was one of the best ways to save for retirement?

It can be, if your employees are making $100,000 or more, if they're contributing a minimum of 5-10% or more of their income, or if you're matching at least up to 3% of their contributions.

To really see the gains and have enough for retirement, someone has to contribute a high amount to the 401(k) every year (typically at least 10% of an employee's salary). Whether it's just your employees -- or if you decide to match -- they'll only have a substantial amount for retirement if contributions amount to at least several thousand dollars or more per year. Very few workers earning $40,000-$70,000 have the ability to take a $4,000-$7,000 pay cut, and most small employers can't afford to match between 3% to 6% per employee.

So is setting up a 401(k) plan worth it?

The honest answer for a small business owner is: maybe, but probably not.

Workers want the option, but most of them won't be able to take advantage of it once it's there. What's worse, if you go to the trouble of providing the option, then many of them will end up losing money on their retirement plan.

Much of this may not come as a surprise to an owner of a small business. It's likely one of the reasons (whether you've thought about it in these terms or not) that you haven't set up a traditional retirement plan.

But employees need a retirement plan, so what's the solution?

To be direct, if you don't help fund your employees savings -- and then "force" them to save it -- then they almost certainly won't save what they should.

Seem like a ridiculous concept? It isn't.

In 2021, the average annual premiums for employer-sponsored health insurance were $7,739 per employee for single coverage and $22,221 for family coverage. Assuming just 15 employees are covered on a typical group plan (all single coverage), that's $187,500 per year. With steadily rising insurance premiums, you can expect to pay more than $2,000,000 in health insurance costs over the next 10 years. Put simply, you're losing too much money in health insurance to provide anything more.

You're tapped out when it comes to benefits.

What if you could cut that number down substantially AND help fund a savings plan that would pay your employees between $25,000 and $80,000 or more, without the hassle of a 401(k)?

That's exactly what we help small business owners do.

What are my options?

You have several, but we'll cover them all (including one you likely haven't considered).

Some of the more common alternatives are direct contribution plans, direct benefit plans, and IRAs.

When it comes to IRAs, there are traditional IRAs, Roth IRAs, SEPs and SIMPLE IRAs. We will be exploring those in another guide soon (there are of course benefits and drawbacks to them all). Another option, however, is a refundable supplemental insurance plan, which returns all unused premiums to employees as savings.

Refundable or Return of Premium (ROP) supplemental insurance plans pay employees directly for the top 5 major medical expenses -- Cancer, Heart Disease, Accidents, ICU stays, and extended hospitalization. If an employee does not decide to use all or a portion of his or her plan for an unexpected health emergency -- the leading cause of bankruptcy and one of the main reasons people withdraw early from their 401(k) plan -- then they are refunded 100% of their monthly premiums as a savings, typically receiving checks for anywhere from $20,000 to $100,000 or more at (or often before) retirement.

These plans require very little effort to put in place, no effort to maintain, do not require annual reporting to the IRS and have zero management fees. They are not exposed to market risk, are not taxed, and have the potential to pay the employee many times more than their total contributions if they undergo a major covered health event.

How do these plans stack up, where it matters most (the money)?

Surprisingly well.

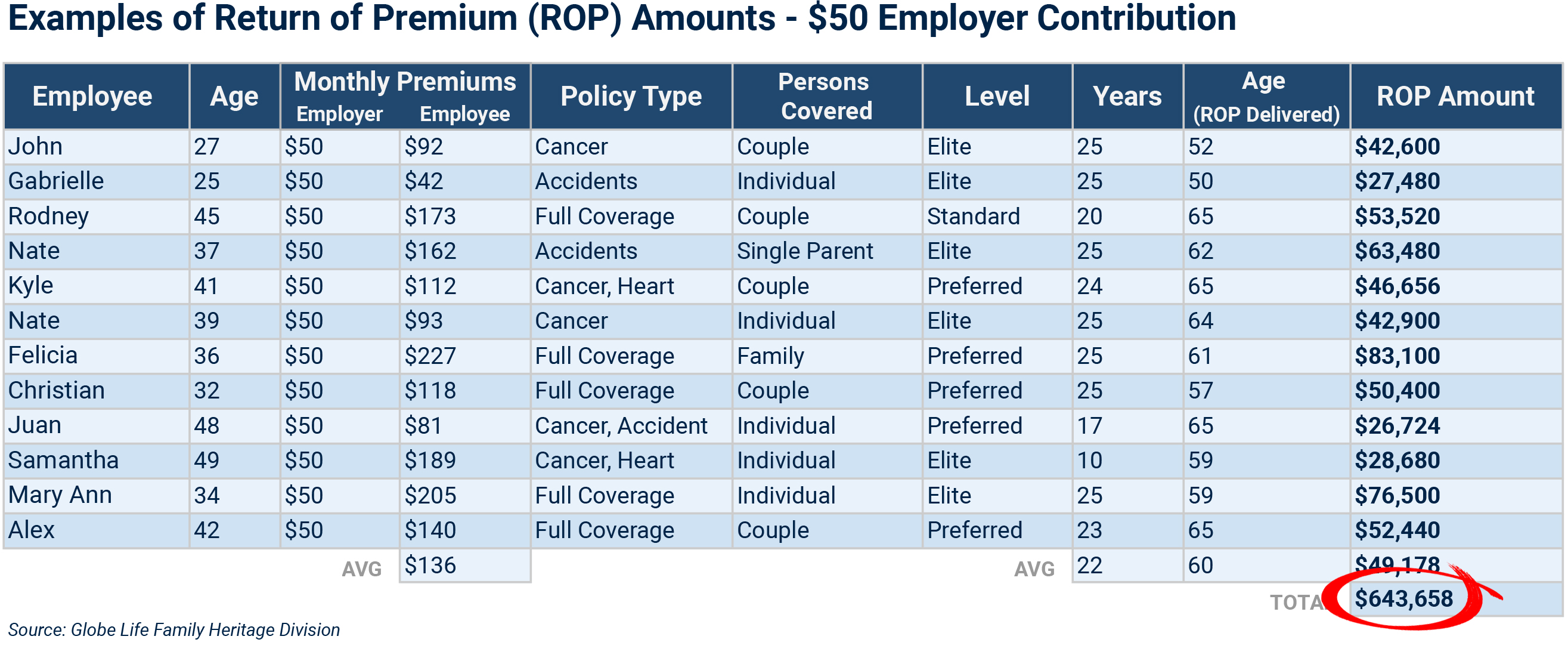

With just $50/month from the employer and a 3% equivalent of salary contribution by the employee ($150 per month for a worker earning $50,000 per year), ROP insurance plans will pay an employee $52,500 over just 25 years.

Pictured below are example policies, premiums, coverage types and return of premium amounts:

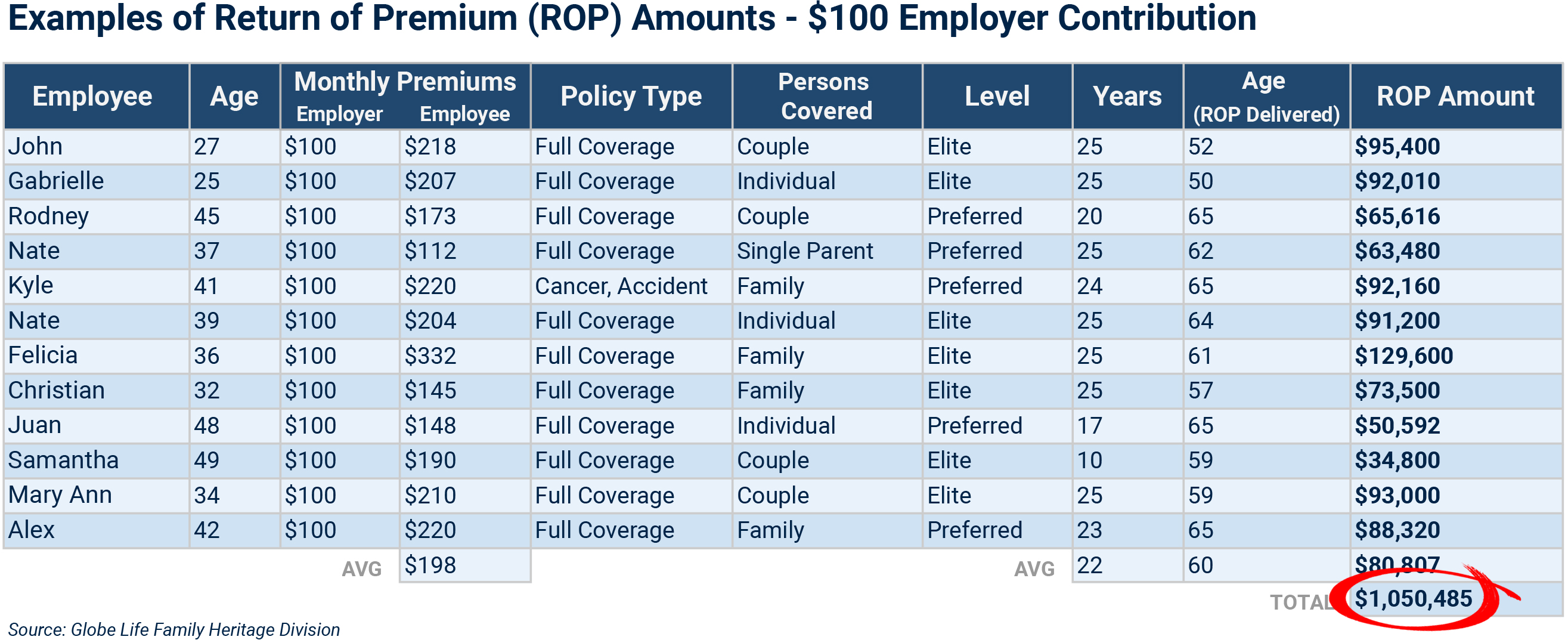

A higher amount of $100 from the employer and 5% of employee salary contributions ($200 per month) turns into a Return of Premium (ROP) amount totaling $90,000. That's equivalent to $113,000 in a taxed retirement plan.

Pictured below are rates and return of premium checks where the employer contributes $100 per month per employee and employees contribute just $62 more per month on average:

What are the benefits (and drawbacks) of refundable supplemental plans for the employer?

The primary benefit is that plans are more cost-effective and vastly easier to implement and maintain. The drawback is that they are not traditional retirement accounts.

As with traditional retirement plans, additional benefits also include tax deductions and improved employee satisfaction and retention. Primarily, the employer will benefit from lower time and cost due to zero employer fees, zero regulatory and compliance burdens, and zero plan management.

For traditional retirement plans, the IRS mandates that in order to be exempt from required annual testing requirements, employers must either (a) match 100% of contributions up to 1% of compensation and 50% for deferrals above 1% (but no more than 6%) or (b) provide nonelective contributions of 3% to all participants. There are no such requirements for refundable supplemental plans.

What are the drawbacks and benefits for my employees?

The primary drawback is that plans cannot be "cashed out" at any time.

Plans build their value and are automatically fully refunded after a period of 25 years or at age 65, whichever comes first. An added benefit is that plans double as supplemental policies that can pay employees many multiples of their value if they undergo a covered health event, such as cancer.

Plans do not accrue interest and are not traditional investments. Employees can cancel plans at any time (and cash value can be redeemed), but the plans do not reach 100% of refundable value until either 25 years or age 65, whichever comes first. If an employee opens an account in May, and undergoes a covered health event in July, then he or she can be paid uncapped benefits immediately.

Plans are never taxed and neither are uncapped benefits. Returns of premium are guaranteed (not exposed to market risk) and cash values for younger employees can be redeemed before the age of 59 without incurring penalties.

Summary

For the great majority of everyday working Americans, the idea of saving enough for retirement in a traditional 401(k) or 403(b) plan is more than appealing. In practice, these plans have fallen short, leaving a comfortable retirement out of reach for tens of millions of employees.

This leaves employers between a rock and a hard place -- offer nothing and lose out on attracting and retaining key talent, or commit to the heavy cost only to see employees under-utilize the plans you put in place.

Our agents are experts at freeing up your capital by streamlining your benefits. We work hand-in-hand with your employees to complete their coverage (often using a portion of your savings), dramatically boosting benefits overall and putting plans in place that pay your employees back -- whether they undergo a major health event or not.

Getting started couldn't be easier. Get a free benefits analysis today by filling out a simple form and scheduling a call. You'll be happy you took the 2 minutes.

Our Process

1) You tell us about your business

2) We send you a free benefits analysis

3) We set up your plan

4) We enroll employees

Who We Serve

Employers (<50)

Employers (50-99)

Employees